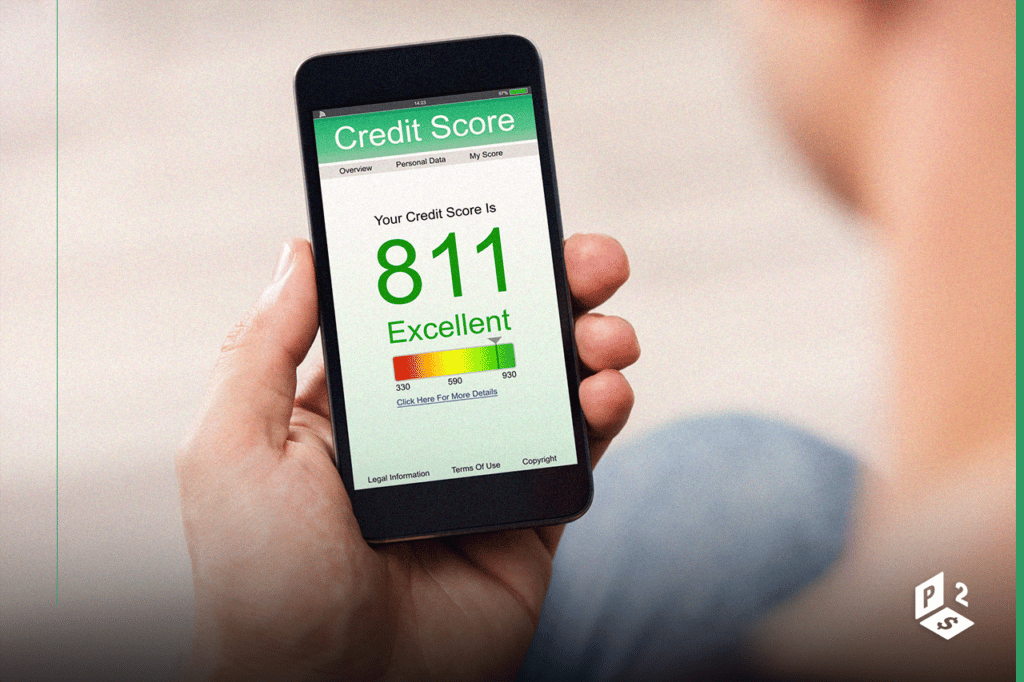

Many people have a lower credit score than they would like, resorting to quick and safe alternatives to improve it. So, to help you we separate some of them, which can guarantee up to 100 points faster.

“Poor” or “Fair” scores hurt some opportunities and offers, so it’s important to increase your rating. See how to do this below.

Is 100 points really realistic?

Anyone who has struggled with their poor credit history knows that raising your score results in quicker gains and better opportunities, even allowing for greater savings.

So you might be wondering if a 100-point increase in your score is realistic and the subject matter experts themselves say it is. Thus, the lower the score of people, the greater the chances of being able to increase it by 100 points. This is because small changes can make big differences and lead to bigger increases in score.

1. Pay credit card balances strategically

Your credit usage, which refers to the portion of your credit limits being used, can affect your score. Therefore, the tip is to use it at less than 30% of your limit on any credit card. The best credit scores only use about 7% of your credit.

This tip is important because your balance is reported to credit agencies, interfering with your score. Another tip to keep it lower is to pay it off before the billing cycle ends or pay it multiple times throughout the month.

2. Ask for higher credit limits

When you increase your credit limit, your balance will remain the same, instantly decreasing your credit usage, which means improving your score. So, if you’re earning a higher income or you’ve added a few more years of positive credit experience, you’ll likely get a higher limit than your current one.

3. Become an authorized user

Another way to improve your credit score is to become an authorized user of a friend or relative who has a high credit limit or a good score. This will contribute to your credit reports and allow you to benefit from the main user’s credit history and positive payments.

4. Pay bills regularly

None of these tips and strategies can help improve your credit score if you don’t pay your bills on time. That’s because late payments directly hurt your credit score, and can stay on your credit report for up to seven and a half years.

If you miss a payment for 30 days or more, call the creditor and pay as soon as possible, asking not to report the delay to the credit bureaus. Every month that you have an account marked as delinquent will take a toll on your credit score.

5. Dispute credit report errors

Disputing errors in your report is another way to help increase your score quickly. That’s because it’s common for your report to have some errors that could be harming your score.

You can request free reports from each of the three major credit bureaus in the country, allowing you to check for any errors, such as payments you made on the appropriate day marked late.

6. Deal with collections accounts

Pay all your collection bills on time and eliminate the threat of being sued for debt and asking the collection agency to stop reporting the debt after you make the payment. Also, remove any charges from your credits if they are old or unnecessary.

7. Use a secured credit card

An insurance card can also be a good alternative for you to build your credit score. This type of card requires you to make a deposit of money before you can start using it. Generally, the amount deposited will match your credit card limit, helping to boost your credit and avoid debt.

8. Get credit for rent and utility payments

There are a few random rental services that can be added to your regularly made rental payments and entered into your credit report, increasing your score faster. That’s because rent payments are not considered FICO scoring models at some agencies.

9. Add to your credit mix

Obtaining an additional credit account in good standing is yet another efficient way to help boost your credit score, especially if you don’t have that type of credit.

If you only have credit cards, consider taking out a loan as an option to build your credit at low cost and add reports to three credit bureaus.

By putting all of these tips into practice, or at least some of them, you will be able to increase your credit score quickly and efficiently, and you can enjoy the benefits offered by a good credit score.

Technical Features and Financial Management of the Inter Passport Card <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Discover the main features of the Inter Passport Card and how it can facilitate the effective management of your personal finances. </p>

Technical Features and Financial Management of the Inter Passport Card <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Discover the main features of the Inter Passport Card and how it can facilitate the effective management of your personal finances. </p>  Inter Passport Card: The Ideal Solution for Managing Your Credit Securely <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Discover how the no-annual-fee card from Banco Inter can help you control your finances and offer benefits on purchases. </p>

Inter Passport Card: The Ideal Solution for Managing Your Credit Securely <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Discover how the no-annual-fee card from Banco Inter can help you control your finances and offer benefits on purchases. </p>