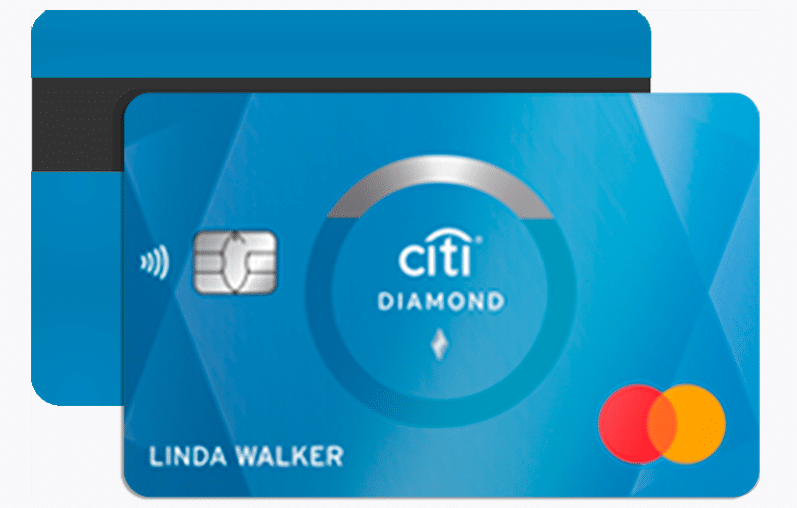

The Citi Secured Mastercard is an excellent tool for individuals looking to build or rebuild their credit. Whether you’re new to credit or recovering from financial setbacks, this secured credit card can help you develop responsible financial habits. Unlike traditional credit cards, it requires a refundable security deposit, but it also provides opportunities for credit growth and responsible spending.

In this comprehensive guide, we’ll explore additional benefits of the Citi Secured Mastercard, discuss the requirements to apply, answer frequently asked questions, and provide a step-by-step guide to help you apply for the card today.

More Benefits of the Citi Secured Mastercard

Reports to All Three Major Credit Bureaus

One of the biggest advantages of the Citi Secured Mastercard is that it reports your payment history to the three major credit bureaus: Equifax, Experian, and TransUnion. This means that every on-time payment you make contributes to your credit history, which can help improve your credit score over time.

Upgrade Potential to an Unsecured Card

With responsible use, you may become eligible to transition from the Citi Secured Mastercard to an unsecured Citi credit card. Citi periodically reviews accounts, and if you demonstrate good credit habits—such as making on-time payments and maintaining a low credit utilization ratio—you could qualify for an upgrade. This allows you to continue building credit without the need for a security deposit.

Fraud Protection and Security Features

The Citi Secured Mastercard offers robust security features, including $0 liability for unauthorized purchases. This means you won’t be responsible for fraudulent charges if your card is lost or stolen. Additionally, you can enable account alerts and digital access through the Citi Mobile App, allowing you to monitor your transactions in real time and manage your account securely.

Requirements to Apply for the Citi Secured Mastercard

Before applying for the Citi Secured Mastercard, it’s important to ensure you meet the eligibility criteria. Here’s what you need:

- Security Deposit Requirement

The Citi Secured Mastercard requires a security deposit, with a minimum of $200. Your deposit amount determines your credit limit, so the more you deposit, the higher your limit. This deposit is refundable when you close your account in good standing or transition to an unsecured card. - U.S. Residency and Legal Age

Applicants must be U.S. residents and at least 18 years old (or 21 in some states) to qualify for the card. A valid Social Security number or Individual Taxpayer Identification Number (ITIN) is also required. - No Recent Bankruptcy

Applicants with recent bankruptcies may not qualify for the Citi Secured Mastercard. Citi considers financial history when evaluating applications, so it’s important to check your credit report before applying. - Proof of Income

Citi may require proof of income to assess your ability to make payments. This can include pay stubs, tax returns, or other financial documents that demonstrate a steady source of income.

Frequently Asked Questions (FAQ)

How does a secured credit card work?

A secured credit card, like the Citi Secured Mastercard, requires a security deposit that acts as collateral. The deposit determines your credit limit, and your payment activity is reported to credit bureaus. Over time, responsible use can help improve your credit score.

When will I get my security deposit back?

Your deposit is refundable when you close your account in good standing or when Citi upgrades you to an unsecured credit card. If you default on your payments, Citi may use your deposit to cover outstanding balances.

Can I increase my credit limit?

Yes. You can increase your credit limit by depositing more funds. Additionally, Citi may offer a credit limit increase if you demonstrate responsible card usage over time.

Does the Citi Secured Mastercard have any rewards?

No, the Citi Secured Mastercard does not offer cashback or travel rewards. Its primary benefit is helping cardholders build credit through responsible use.

How long does it take to improve my credit score with this card?

Credit improvement depends on factors such as payment history and credit utilization. If you make on-time payments and keep your balance low, you may start seeing positive changes in your credit score within a few months.

Step-by-Step Guide: How to Apply for the Citi Secured Mastercard

- Step 1: Check Your Eligibility

Review the card’s requirements, including the need for a refundable security deposit and a stable source of income. Ensure you meet Citi’s qualifications before applying. - Step 2: Gather Necessary Documents

Have your Social Security number (or ITIN), proof of income, and a valid U.S. address ready. These details will be required during the application process. - Step 3: Visit the Citi Website

Go to the official Citi website and navigate to the Citi Secured Mastercard application page. Here, you’ll find details about the card, including benefits and requirements. - Step 4: Complete the Application

Fill out the application form with your personal and financial information. Be honest and accurate when entering your details, as this helps Citi assess your eligibility. - Step 5: Choose Your Security Deposit Amount

Select the amount you want to deposit, with a minimum of $200. Your deposit will determine your initial credit limit. - Step 6: Submit Your Application

Review all the details carefully and submit your application. In most cases, Citi will provide a decision within a few minutes. If further review is needed, you may receive a response within a few days. - Step 7: Fund Your Security Deposit

If approved, you’ll need to fund your security deposit. Citi will provide instructions on how to submit your deposit payment, which is required before you receive your card. - Step 8: Receive and Activate Your Card

Once your deposit is processed, Citi will mail your Citi Secured Mastercard. Upon receiving it, activate your card online or via the Citi mobile app. You can then start using your card to make purchases and build credit.

Final Thoughts

The Citi Secured Mastercard is a great option for those who want to build or rebuild their credit. With features like no annual fee, fraud protection, and the opportunity to upgrade to an unsecured card, this card provides a strong foundation for financial growth. If you’re ready to take control of your credit journey, apply today and start building a brighter financial future!

Technical Features and Financial Management of the Inter Passport Card <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Discover the main features of the Inter Passport Card and how it can facilitate the effective management of your personal finances. </p>

Technical Features and Financial Management of the Inter Passport Card <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Discover the main features of the Inter Passport Card and how it can facilitate the effective management of your personal finances. </p>  Inter Passport Card: The Ideal Solution for Managing Your Credit Securely <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Discover how the no-annual-fee card from Banco Inter can help you control your finances and offer benefits on purchases. </p>

Inter Passport Card: The Ideal Solution for Managing Your Credit Securely <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Discover how the no-annual-fee card from Banco Inter can help you control your finances and offer benefits on purchases. </p>