TD car financing is more than just a loan; it’s a strategic financial solution tailored to make vehicle ownership accessible and convenient. While many online resources outline basic financing details, this guide dives into lesser-known insights, pre-requisites, and insider strategies to enhance your chances of approval while securing optimal terms.

Additional Advantages of TD Car Financing

1. Personalized Loan Customization

Unlike standard financing programs, TD allows borrowers to customize their loan structures. Beyond term length and payment schedules, clients can negotiate options such as deferred payments for initial months, seasonal payment adjustments, or partial balloon payments, making it easier to align the loan with personal cash flow.

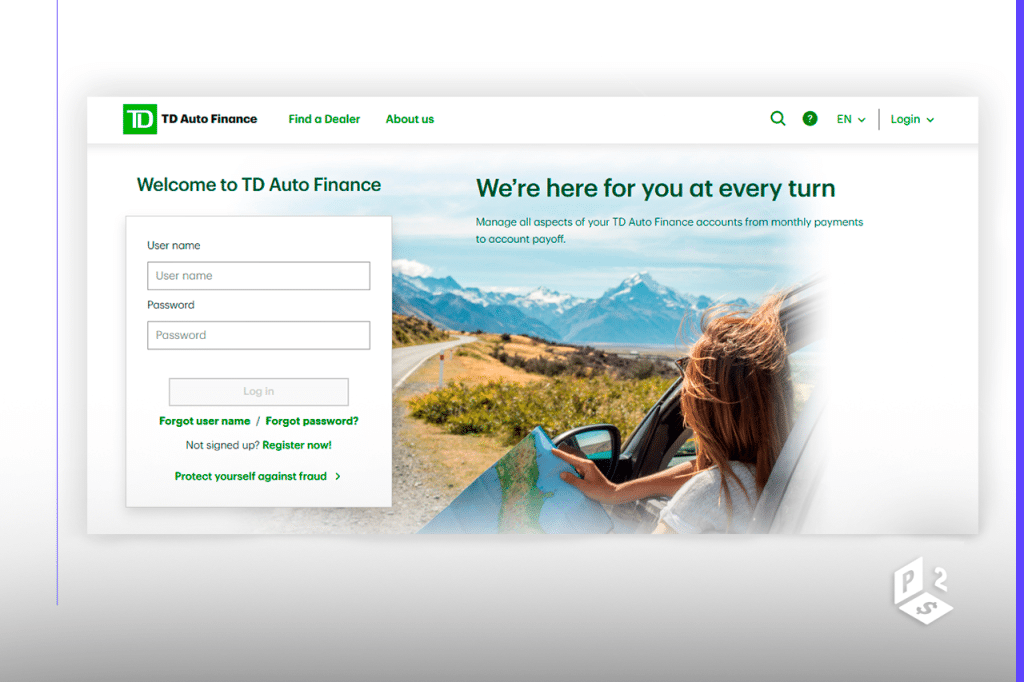

2. Strong Digital Platform Integration

TD’s online platform is designed for transparency and efficiency. Applicants can pre-qualify, simulate monthly payments, track application status, and even manage repayments digitally. This integration reduces administrative hurdles and provides borrowers with a clear understanding of total financing costs from the outset.

3. Enhanced Protection Options

TD offers access to insurance packages and extended warranty programs that can be bundled with car financing. These protections often include gap insurance, theft protection, and coverage for unexpected mechanical issues, which are not widely emphasized by other lenders.

4. Loyalty Incentives for Existing Customers

TD frequently rewards existing banking clients with interest rate reductions, reduced processing fees, or priority access to high-demand models. Leveraging multiple TD accounts or products can significantly enhance financing terms and overall value.

Eligibility and Pre-Requisites for TD Car Financing

Before applying, ensure you meet TD’s core requirements to avoid delays or rejections.

- Credit Score: While TD is flexible, a higher credit score increases approval chances and reduces interest rates.

- Proof of Income: Stable and verifiable income documentation is required to demonstrate repayment capacity.

- Debt-to-Income Ratio: TD assesses current obligations to determine affordability; a ratio below 40% is ideal.

- Residency Status: Applicants must be residents or citizens of countries where TD operates.

- Age Requirement: Minimum age to apply is 18 years, though co-signers may be necessary for younger applicants.

Frequently Asked Questions (FAQ)

Q1: Can I finance a used car through TD? Yes, TD offers financing for both new and pre-owned vehicles, with specific programs designed to accommodate varying depreciation and risk factors.

Q2: How quickly can I get approved? Online pre-approval can take as little as 24 hours, while full approval including document verification may take 2–5 business days.

Q3: Can I pay off my loan early? Yes, TD allows early repayment with minimal or no prepayment penalties, which can save interest over time.

Q4: Are co-signers required? Not always, but applicants with lower credit scores or irregular income may benefit from having a co-signer to secure favorable terms.

Q5: Can I adjust my payment schedule after approval? TD permits certain adjustments post-approval, including payment deferments or schedule changes, subject to loan agreement terms.

Step-by-Step Guide to Apply for TD Car Financing

- Pre-qualification: Use TD’s online platform to check eligibility and potential loan amounts without affecting your credit score.

- Select Vehicle: Choose your preferred model and gather necessary details including VIN, mileage, and purchase price.

- Prepare Documentation: Collect proof of income, identification, residency proof, and any other financial records.

- Submit Application: Apply online or in-branch, specifying loan amount, term, and preferred payment schedule.

- Review and Approval: TD reviews your application, conducts credit assessment, and confirms loan terms.

- Finalize Agreement: Sign the loan contract, optionally select insurance or protection packages, and arrange for vehicle delivery or pick-up.

Tips to Maximize Approval Chances

- Optimize Your Credit Score: Paying down outstanding debts and correcting errors on credit reports can significantly improve your interest rates.

- Increase Down Payment: Larger down payments reduce lender risk and often result in lower monthly installments.

- Leverage Existing TD Accounts: Bundling services or showing a long-term banking relationship with TD can enhance loan approval odds.

- Maintain Stable Employment: Demonstrating consistent income history reassures TD of your repayment reliability.

- Request Personalized Consultation: Speaking with TD financing specialists can uncover exclusive offers and strategic options not publicly advertised.

By following these tips and understanding the nuances of TD car financing, borrowers can confidently navigate the application process and secure favorable loan conditions.

Securing a TD car loan is a strategic step toward owning your ideal vehicle while optimizing financial outcomes. From personalized loan customization to digital application efficiency, TD’s financing options cater to modern car buyers seeking both flexibility and reliability. Take the next step today and unlock access to exclusive TD financing benefits designed to make your dream car a reality.

Exclusive Guide to Toyota Car Financing | Maximize Your Loan Benefits <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Drive Your Dream Toyota Without Breaking the Bank </p>

Exclusive Guide to Toyota Car Financing | Maximize Your Loan Benefits <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Drive Your Dream Toyota Without Breaking the Bank </p>  Advanced Toyota Car Financing Tips: Maximize Your Approval and Benefits <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Secure Your Toyota With Smart Financing Strategies </p>

Advanced Toyota Car Financing Tips: Maximize Your Approval and Benefits <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Secure Your Toyota With Smart Financing Strategies </p>