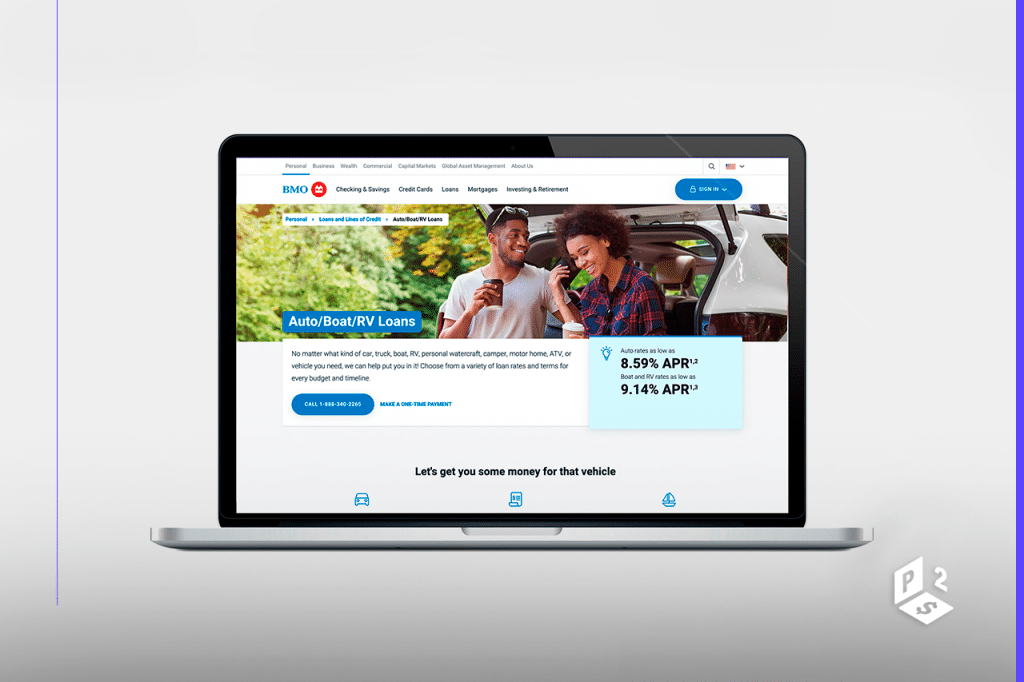

Choosing the right lender can make or break your car financing experience. While many buyers focus only on the interest rate, BMO Harris stands out with a combination of borrower-friendly policies, transparent terms, and specialized support. In this in-depth guide, we go beyond the common information found on most websites and uncover hidden benefits, eligibility requirements, and insider tips to help you maximize your chances of approval. Whether you’re buying a new car, refinancing, or consolidating debt, BMO Harris could be the right partner for your journey.

Additional Advantages of BMO Harris Auto Loans

While competitive rates and flexible repayment terms are well known, there are several lesser-discussed perks that add significant value to borrowers:

1. Seamless Digital Tools

BMO Harris integrates powerful online tools, including an auto loan calculator and personalized dashboards, allowing borrowers to simulate payments, compare interest scenarios, and track progress. This level of transparency is particularly beneficial for budget-conscious buyers.

2. Refinancing Opportunities

Unlike some lenders that focus solely on new loans, BMO Harris actively supports refinance car loan applications. Borrowers can replace high-interest dealership loans with more affordable options, potentially lowering monthly payments and saving thousands over the life of the loan.

3. Bundled Financial Benefits

Customers with existing BMO Harris accounts often qualify for preferential auto loan rates or reduced fees. By consolidating banking services—checking, savings, or mortgage—you may unlock exclusive discounts unavailable to non-clients.

4. Wide Vehicle Eligibility

While some lenders restrict financing to new models, BMO Harris allows loans for used vehicles (within certain age and mileage limits). This flexibility helps buyers who prefer reliable pre-owned cars with lower overall costs.

Key Requirements Before Applying

To ensure a smooth approval process, you’ll need to prepare specific information that goes beyond the basics. Here are the essential prerequisites:

- Credit Score for Car Loan: While there is no official minimum published, applicants with a credit score above 670 are more likely to secure the best auto loan rates. Scores between 580–669 may still qualify but usually at higher APRs.

- Income Documentation: Proof of consistent income is required. This typically includes recent pay stubs, W-2 forms, or tax returns for self-employed applicants.

- Debt-to-Income Ratio (DTI): Lenders evaluate your ability to handle new debt. A DTI below 40% is considered favorable.

- Vehicle Information: Applicants must provide details about the car’s VIN, age, mileage, and sale price. BMO Harris uses this to determine eligibility and loan-to-value (LTV) ratios.

- Proof of Insurance: Borrowers are generally required to show evidence of auto insurance before final loan approval.

Frequently Asked Questions (FAQ)

1. Can I get pre-approved for a BMO Harris auto loan?

Yes. Pre-approval is available and allows you to shop for vehicles with confidence, knowing your financing terms upfront.

2. Does BMO Harris finance private-party sales?

In many cases, yes. Unlike lenders that only work with dealerships, BMO Harris can finance private transactions, provided the vehicle meets eligibility criteria.

3. Is there an option to skip a payment in case of financial hardship?

While not guaranteed, BMO Harris may offer temporary relief programs. Contacting customer service proactively is the best approach.

4. How long does approval usually take?

Most applications are processed within 24–48 hours, though documentation issues can extend this timeline.

5. Can I refinance an existing loan from another bank?

Absolutely. Many customers use BMO Harris to replace high-cost auto loans with more affordable monthly payments.

Step-by-Step Guide to Applying for a BMO Harris Auto Loan

- Check Your Credit Score: Review your report and resolve discrepancies before applying.

- Use the Auto Loan Calculator: Estimate your monthly payment and select a loan term that fits your budget.

- Gather Required Documents: Prepare ID, proof of income, and insurance information.

- Submit Online Application: Apply directly through BMO Harris’s secure portal or visit a local branch.

- Review Loan Offer: Once approved, carefully evaluate APR, term length, and total cost of the loan.

- Finalize Agreement: Provide vehicle details, sign documents, and arrange disbursement of funds.

- Drive Away: Once the loan is funded, you’re ready to complete your purchase or refinance process.

Tips to Increase Your Chances of Approval

- Improve Your Credit Profile: Pay down revolving balances and avoid opening new credit lines right before applying.

- Opt for a Co-Signer: A strong co-signer can lower your risk profile and potentially secure lower APRs.

- Choose the Right Loan Term: Lenders view shorter terms more favorably, as they reduce long-term risk.

- Make a Larger Down Payment: This lowers the loan-to-value ratio, signaling less risk to the bank.

- Consolidate Banking with BMO Harris: Existing clients often receive rate discounts and faster approval timelines.

- Avoid Overfinancing: Financing add-ons like warranties or accessories can push your DTI ratio higher, reducing approval odds.

Final Thoughts

BMO Harris auto loans go far beyond offering just competitive interest rates. With refinancing opportunities, exclusive account-holder benefits, and flexible eligibility for used vehicles, this lender provides real value for individuals seeking both affordable monthly payments and long-term financial confidence. By preparing your documents, understanding the approval requirements, and applying proven strategies to strengthen your application, you can position yourself to secure one of the best car loan deals available.

For buyers serious about making an informed decision, BMO Harris is not just another lender—it’s a strategic partner in helping you drive away with confidence.

Westlake Financial Services: Benefits, Requirements and Application Process <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlock the benefits, understand the requirements, and learn how to apply for a car loan with Westlake Financial Services </p>

Westlake Financial Services: Benefits, Requirements and Application Process <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlock the benefits, understand the requirements, and learn how to apply for a car loan with Westlake Financial Services </p>  Huntington Car Financing: Your Complete Guide to Auto Loans <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlocking the Road to Your Next Vehicle </p>

Huntington Car Financing: Your Complete Guide to Auto Loans <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlocking the Road to Your Next Vehicle </p>  BMO Harris Car Loan Financing: Your Path to Vehicle Ownership <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlock Competitive Rates and Flexible Terms </p>

BMO Harris Car Loan Financing: Your Path to Vehicle Ownership <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlock Competitive Rates and Flexible Terms </p>