Navigating the world of auto financing can be daunting, especially if your credit history isn’t perfect. Westlake Financial Services offers tailored financing solutions to help individuals secure car loans, even with less-than-ideal credit scores. With a range of programs designed to accommodate various financial situations, Westlake aims to make car ownership accessible to more people.

Additional Advantages of Westlake Financial Services

1. Specialty Vehicle Financing

Westlake Financial Services extends its financing options to specialty vehicles, including:

- Recreational Vehicles (RVs): Financing available for various types of RVs, catering to different travel and lifestyle needs.

- Commercial Vehicles: Options for financing commercial vehicles, supporting businesses in acquiring necessary transportation.

- Classic and Exotic Cars: Tailored financing solutions for classic and exotic car enthusiasts, facilitating the purchase of unique vehicles.

- Highline Vehicles: Financing for high-end vehicles, allowing access to luxury cars with flexible terms.

These specialized programs ensure that a wide array of vehicle types are accessible to potential buyers, broadening the scope of financing options available.

2. No Minimum Income or Job Tenure Requirements

Westlake Financial Services does not impose minimum income or job tenure requirements for its loan applicants. This policy is particularly beneficial for individuals with unconventional employment histories or those in transitional phases of their careers. It allows a broader range of applicants to qualify for financing, reducing barriers to car ownership.

3. Flexible Loan Terms and Down Payments

Loan terms with Westlake Financial Services are flexible, ranging from 48 to 72 months. Additionally, down payments can be as low as $0, depending on the applicant’s credit profile. This flexibility enables borrowers to choose terms that align with their financial situations, making monthly payments more manageable.

Prerequisites for Applying

To apply for a car loan with Westlake Financial Services, consider the following prerequisites:

- Basic Personal Information: Provide your full name, date of birth, phone number, and email address.

- Employment and Income Details: While there are no strict minimum requirements, providing information about your employment status and income can facilitate the application process.

- Vehicle Information: Details about the vehicle you intend to purchase, including make, model, year, and mileage.

- Proof of Identity and Residency: Documents such as a driver’s license and utility bills to verify your identity and address.

- Credit History: Westlake Financial Services considers applicants with varying credit histories, including those with less-than-perfect credit.

It’s advisable to gather these documents and information before starting the application process to ensure a smooth experience.

Frequently Asked Questions (FAQ)

1. Does Westlake Financial Services finance used cars?

Yes, Westlake Financial Services finances both new and used cars. They have partnerships with a network of dealerships nationwide, offering a wide selection of vehicles.

2. Can I apply for a loan with bad credit?

Absolutely. Westlake Financial Services specializes in providing financing solutions for individuals with less-than-ideal credit histories. Their programs are designed to accommodate a range of credit profiles.

3. Is a down payment required?

While down payments are typically required, they can be as low as $0 for applicants with strong credit profiles. The specific down payment amount may vary based on your creditworthiness and the vehicle’s value.

4. How long does the approval process take?

The approval process is relatively swift, with many applicants receiving decisions within minutes. However, the exact time may vary depending on the completeness of your application and the verification of provided information.

5. Can I refinance my loan with Westlake Financial Services?

Yes, Westlake Financial Services offers refinancing options for existing loans. This can be beneficial if you’re looking to adjust your loan terms or interest rate.

Step-by-Step Guide to Applying for a Car Loan

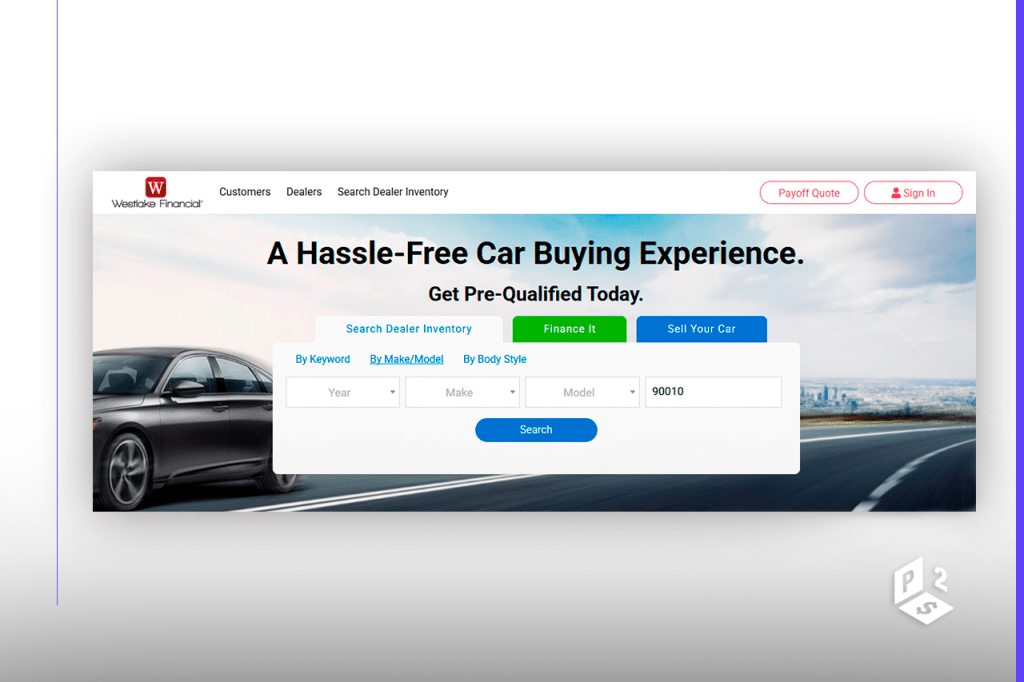

- Visit the Westlake Financial Services Website: Navigate to their official site and locate the auto loan section.

- Start the Pre-Qualification Process: Fill out the pre-qualification form with your personal and financial information. This step does not impact your credit score.

- Review Your Loan Options: Based on your information, Westlake will present you with personalized loan offers, including interest rates, terms, and down payment requirements.

- Select a Dealership: Choose a dealership from Westlake’s network that offers the vehicle you’re interested in purchasing.

- Finalize Your Loan Application: Submit any additional required documents to the dealership, such as proof of identity and income.

- Sign the Loan Agreement: Once approved, review and sign the loan agreement.

- Take Delivery of Your Vehicle: After completing all formalities, you can take possession of your new or used vehicle.

Throughout this process, Westlake Financial Services provides support to ensure a smooth and efficient experience.

Tips to Increase Your Approval Chances

- Maintain a Stable Employment History: A consistent job history can positively influence your application.

- Provide Accurate and Complete Information: Ensure all details in your application are accurate and complete to avoid delays.

- Consider a Co-Signer: If possible, having a co-signer with a stronger credit profile can improve your chances of approval and may result in better loan terms.

- Choose a Reasonably Priced Vehicle: Opting for a vehicle within your budget can make the loan more manageable and increase approval likelihood.

- Review Your Credit Report: Check your credit report for any errors and dispute them before applying to ensure your credit history is accurately represented.

By following these tips, you can enhance your application and increase your chances of securing favorable financing terms with Westlake Financial Services.

Huntington Car Financing: Your Complete Guide to Auto Loans <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlocking the Road to Your Next Vehicle </p>

Huntington Car Financing: Your Complete Guide to Auto Loans <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlocking the Road to Your Next Vehicle </p>  BMO Harris Car Loan Financing: Your Path to Vehicle Ownership <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlock Competitive Rates and Flexible Terms </p>

BMO Harris Car Loan Financing: Your Path to Vehicle Ownership <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlock Competitive Rates and Flexible Terms </p>  BMO Harris Auto Loan Guide: Extra Benefits, Requirements & Approval Tips <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Beyond the Basics: Why BMO Harris Deserves Your Attention </p>

BMO Harris Auto Loan Guide: Extra Benefits, Requirements & Approval Tips <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Beyond the Basics: Why BMO Harris Deserves Your Attention </p>